Comprehensive Guide to Inheritance Law in Turkey | Partners ASB

Inheritance law is a vital legal area that governs the transfer of a person’s assets after their death. Understanding the nuances of inheritance law in Turkey is crucial for heirs, beneficiaries, and anyone involved in estate planning or disputes. The legal framework ensures fair distribution while protecting the rights of all parties involved.

In this guide, we will explore the key aspects of inheritance law, including who the legal heirs are, the probate process, contesting wills, tax implications, and dispute resolution. Whether you are planning your estate, facing a complex inheritance issue, or simply seeking clarity on your rights, this article provides a clear and comprehensive overview tailored to your needs.

Partners ASB is dedicated to offering expert legal guidance throughout inheritance matters, helping clients navigate the complexities with confidence and ease.

Table of Contents

What is Inheritance Law?

Inheritance law governs the transfer of a deceased person’s assets, rights, and obligations to their legal heirs or designated beneficiaries. In Turkey, this area of law is regulated primarily by the Turkish Civil Code, which ensures that inheritance is handled transparently, equitably, and in accordance with the deceased’s wishes—so long as legal limitations are respected.

The purpose of inheritance law is twofold: to protect the rightful claims of close relatives and to provide individuals the freedom to distribute their assets through wills. It outlines who can inherit, how estates are distributed, and what happens in cases of disputes or legal challenges.

Understanding inheritance law is essential not only for those inheriting assets but also for those planning their estates. At Partners ASB, we provide expert guidance to ensure every step—from will drafting to estate distribution—is legally compliant and strategically sound.

Legal Heirs and Their Rights

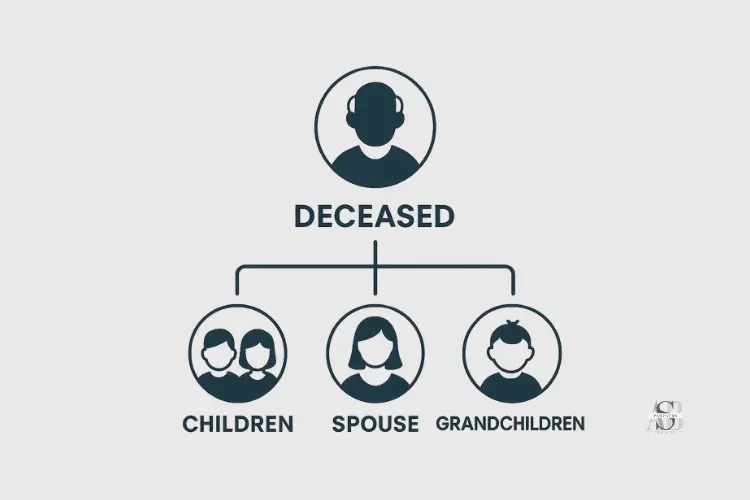

According to Turkish law, legal heirs are categorized by degree:

First-degree heirs: spouse, children, parents

Second-degree heirs: siblings, grandparents

Third-degree heirs: aunts, uncles, and more distant relatives

Each heir is entitled to a share of the estate according to legal ratios. The law particularly protects the rights of spouses and children. Inheritance shares can also be influenced by any valid testamentary dispositions made by the deceased.

Types of Heirs in Turkish Inheritance Law

Turkish inheritance law categorizes heirs into statutory (legal) heirs and appointed (testamentary) heirs. The classification determines how assets are distributed and who has legal priority.

1. Statutory Heirs (Legal Heirs)

These are determined directly by the law and are grouped into inheritance classes:

First-degree heirs: Children and descendants (e.g., grandchildren). If a child has died, their share passes to their children. The spouse, if present, also inherits alongside them.

Second-degree heirs: Parents of the deceased and their descendants (siblings of the deceased).

Third-degree heirs: Grandparents of the deceased and their descendants (uncles, aunts, cousins).

Spouse: The surviving spouse inherits together with the relevant class and holds a variable share depending on the degree of other heirs.

The state: If no legal heirs or will exist, the assets are transferred to the Treasury.

2. Appointed Heirs (Heirs by Will)

An individual may designate a beneficiary in a will. However, Turkish law imposes restrictions to protect the reserved shares of legal heirs, meaning appointed heirs cannot receive more than what’s legally permissible if it violates these shares.

Understanding these classifications is crucial for rightful inheritance distribution and avoiding disputes. At Partners ASB, we assist both legal heirs and appointed beneficiaries in asserting and protecting their rights.

Business owners and company shareholders must also consider the impact of inheritance law on corporate ownership structures.

Creating a Will and Validating Its Legality

A will (testament) allows individuals to express their final wishes regarding the distribution of their estate. In Turkey, the creation and validation of a will are strictly regulated by the Turkish Civil Code to ensure fairness and legal certainty.

Types of Wills in Turkey

Official Will (Notarized)

Prepared and certified by a notary public with at least two witnesses. This is the most reliable and commonly accepted form of will.Handwritten Will

Entirely written, dated, and signed by the testator in their own handwriting. Typed documents are invalid. Though valid, this type of will can be more easily challenged.Oral Will

Used only in exceptional circumstances (e.g., war, imminent death) when other types of wills are not feasible. Must be declared in front of two witnesses and later submitted to court.

Legal Requirements for a Valid Will

The testator must be at least 15 years old and of sound mental capacity.

The will must be created freely, without coercion or manipulation.

Formal requirements (e.g., signature, date, witnesses) must be fulfilled.

The will must not infringe on the reserved shares of statutory heirs.

A will that fails to meet these requirements can be declared partially or entirely invalid by the courts. Therefore, seeking professional legal support is essential.

At Partners ASB, we help clients draft legally valid wills that respect their wishes while staying compliant with Turkish law.

Reserved Share and Action for Reduction

In Turkish inheritance law, reserved shares (saklı paylar) are legally protected portions of an estate that must go to certain statutory heirs, regardless of the deceased’s will. This legal mechanism prevents individuals from disinheriting close family members entirely.

Who Is Entitled to a Reserved Share?

The following heirs are entitled to a statutory reserved portion:

Children and descendants: 50% of their legal share

Parents: 25% of their legal share

Surviving spouse: A portion depending on the heir class present

Siblings: Only in the absence of other close relatives, with a smaller reserved share

These percentages are calculated based on what the heir would receive under intestate succession (i.e., if there were no will).

What Is an Action for Reduction (Tenkis Davası)?

If a will or lifetime donation violates the reserved shares of statutory heirs, affected parties may file an Action for Reduction (tenkis davası) in court. This lawsuit seeks to annul or reduce the transfer of property that exceeds the disposable portion of the estate.

Key features of the action:

Must be filed within 1 year after learning of the violation

Cannot exceed 10 years from the date of death

Applies to wills, gifts, or sales meant to bypass inheritance rules

The court examines the estate’s value, the shares due, and the excessive allocations. Any unlawful allocation is then proportionally reduced to restore the rightful shares of the heirs.

ASB Partners offers comprehensive legal representation for heirs pursuing or defending against an action for reduction, ensuring inheritance rights are enforced under Turkish law.

Cancellation of a Will

A will can be contested and cancelled under Turkish law if it does not meet legal standards or if it violates the rights of statutory heirs. The cancellation of a will (vasiyetnamenin iptali) is a formal legal process initiated through court action and can result in the partial or complete invalidation of the testament.

Legal Grounds for Cancellation

Turkish Civil Code outlines specific situations where a will may be cancelled:

Lack of mental capacity

If the testator was not of sound mind at the time the will was made (e.g., due to illness or senility), the will can be annulled.Improper influence or coercion

If the will was created under pressure, threat, or manipulation by another party, it is considered invalid.Violation of legal formalities

Missing signatures, incorrect formatting, or failing to follow notarization procedures can render a will void.Fraud or deception

If the testator was misled about the content of the will or the beneficiaries, the document may be declared null.

How to File for Cancellation

A cancellation case is filed in civil court by interested parties, such as heirs or those adversely affected by the will. The lawsuit must be filed:

Within 1 year from the date the plaintiff becomes aware of the grounds for cancellation

Within 10 years from the date of the testator’s death, regardless of when the will was discovered

Courts examine witness statements, medical records, and legal documents to assess the validity of the will.

At Partners ASB, we assist clients with building strong cases to challenge or defend a will’s validity, ensuring their rights and the testator’s true intentions are upheld.

Estate Fraud and Title Deed Cancellation Lawsuit

Estate fraud is a serious issue in inheritance cases and can involve the unlawful transfer, concealment, or manipulation of assets to deprive rightful heirs of their shares. One of the most common forms of estate fraud in Turkey involves the improper transfer of real estate, which can be challenged through a title deed cancellation lawsuit (tapu iptal ve tescil davası).

What Constitutes Estate Fraud?

Fictitious sales: A deceased person may appear to have sold property to someone (often a relative or third party), but the transaction was never real—done solely to keep it out of the inheritance.

Disguised donations: A “sale” may actually be a gift, made to sidestep inheritance rights.

Forgery or backdating: Manipulated documents or backdated contracts to make assets appear transferred before death.

Legal Remedy: Title Deed Cancellation and Re-registration

Heirs who suspect fraud may file a title deed cancellation lawsuit to reclaim illegally transferred property. The goal of this case is:

To prove that the transaction was fictitious or fraudulent

To cancel the current title deed

To re-register the property in the name of the rightful heirs

Time Limits

These lawsuits generally must be filed within 10 years from the fraudulent transfer.

In some cases, the deadline may be shorter if the fraud was discovered earlier.

Proving fraud often requires detailed legal work, document examination, and witness testimony. Partners ASB provides experienced litigation support in such cases, protecting your inheritance rights and pursuing justice for fraudulent transfers.

Inheritance Partition Agreement

After an estate is legally transferred to heirs, the shared ownership of the inherited assets can lead to management complications and disputes. To resolve these, Turkish inheritance law allows for an Inheritance Partition Agreement (Miras Taksim Sözleşmesi)—a legally binding contract in which heirs agree on how to divide the estate among themselves.

What Is an Inheritance Partition Agreement?

It is a mutual agreement signed by all legal heirs to distribute the estate’s assets according to either:

Equal statutory shares (as defined by law), or

A customized division based on each heir’s wishes and consent

The agreement allows for division of movable property (such as bank accounts, vehicles) and immovable property (such as real estate) in a way that avoids prolonged co-ownership and potential legal conflicts.

Legal Requirements

Must be signed by all heirs—even one heir’s refusal invalidates the agreement

Must be in written form and notarized if real estate is involved

Parties may involve legal advisors to ensure fair and lawful distribution

Why It Matters

Without a partition agreement, heirs remain in joint ownership (elbirliği mülkiyeti), which limits individual control and makes asset sale or use more difficult. This can also lead to disagreements over property use or management.

Partners ASB supports clients through the preparation, negotiation, and notarization of inheritance partition agreements, ensuring a smooth and dispute-free division process.

Some foreign heirs may also be eligible to apply for Turkish citizenship following the inheritance of assets.

Action for Dissolution of Partnership

When heirs inherit assets together—especially real estate—they often become co-owners under a legal structure called joint ownership (elbirliği mülkiyeti). This means that no heir can unilaterally sell, rent, or divide the property without the consent of all others. If an agreement cannot be reached, the legal solution is to initiate an Action for Dissolution of Partnership (Ortaklığın Giderilmesi Davası).

What Is a Dissolution of Partnership?

It is a court case filed by one or more co-heirs requesting the legal termination of joint ownership. This action allows the shared property to be:

Physically divided (if possible), or

Sold via public auction, with proceeds distributed proportionally among heirs

When Is It Necessary?

One or more heirs want to liquidate their share

Heirs disagree on what to do with the property

The property is not usable or manageable in its current co-owned state

Legal Process

Filed in the Civil Court of Peace where the property is located

The court evaluates whether physical division is possible

If not, the property is sold by public auction (ihale)

Proceeds are distributed after deducting court costs and debts

This type of lawsuit is often the last resort when family negotiations fail. At Partners ASB, we assist clients in both pursuing and defending against partnership dissolution claims, aiming to resolve property disputes efficiently and with minimal conflict.

Determination of the Estate

Before any inheritance can be distributed among heirs, it is essential to identify and verify the entirety of the deceased person’s assets and liabilities. This process is called the Determination of the Estate (Terekenin Tespiti) and is a crucial step in ensuring lawful and transparent inheritance.

Purpose of Estate Determination

To list all movable and immovable properties of the deceased

To identify debts and obligations owed by or to the estate

To prevent the concealment, misuse, or illegal transfer of assets

To protect creditors’ rights and ensure fair distribution to heirs

How the Process Works

Application to Court

Heirs, creditors, or other interested parties can apply to the Civil Court of Peace to initiate this process.Court-Ordered Inventory

The court may appoint officials to inspect, seal, or list the estate’s contents, including bank accounts, real estate, vehicles, business shares, and personal belongings.Witness Testimonies and Documents

The court may request statements from family members or institutions to help confirm ownership and debts.Official Estate Inventory (Tereke Tespit Tutanağı)

A detailed document is issued, listing all identified items and obligations, forming the basis for later partition or liquidation.

Legal Significance

Prevents disputes among heirs about missing or hidden assets

Enables accurate calculation of reserved shares and tax obligations

Helps courts resolve inheritance claims fairly and efficiently

At Partners ASB, we assist clients in requesting and monitoring estate determination procedures, ensuring that all inheritance proceedings start with a full and fair accounting of the deceased’s property.

Inheritance Certificate Procedures

An Inheritance Certificate (Veraset İlamı) is an official document that confirms who the legal heirs of a deceased person are and what share each heir is entitled to. It is a mandatory prerequisite for accessing or transferring any inherited property or right in Turkey.

What Is an Inheritance Certificate?

Also known as a Certificate of Succession, it establishes the legal status of heirs and their respective shares in the estate. Without it, heirs cannot:

Withdraw money from the deceased’s bank account

Sell or transfer inherited property

Initiate any legal action related to the estate

Where and How to Obtain It

Application to the Civil Court of Peace

Heirs must submit a formal request to the court in the district where the deceased resided. Required documents include:Death certificate

Family registry (nüfus kayıt örneği)

Identity documents of the applicants

Notary Public Option

If there is no foreign heir, dispute, or contested will, the inheritance certificate can also be obtained more quickly via a notary.Court Review and Decision

The court examines the documents, and if there are no objections, issues the inheritance certificate detailing:Each heir’s identity

The percentage of inheritance they are entitled to

Applicable limitations or notes (e.g., guardianship, reserved shares)

Importance for Legal Transactions

Banks, land registries, and tax offices all require the inheritance certificate before permitting any action related to the deceased’s assets. For foreign heirs, additional notarized translations and apostilles may be necessary.

At Partners ASB, we guide clients—both domestic and international—through each step of the inheritance certificate process, ensuring all legal and bureaucratic requirements are handled efficiently.

In some cases, especially when public property or foreign heirs are involved, issues related to administrative processes or objections may arise.

Quick Summary: Inheritance Law in Turkey

Inheritance Law in Turkey is governed by the Turkish Civil Code and ensures fair distribution of assets upon death, protecting both legal heirs and the deceased’s final wishes.

Heirs are categorized into statutory and appointed groups, with close relatives like children and spouses enjoying priority and legal protection.

Wills must meet strict legal standards to be valid. Testamentary freedom is allowed but limited by reserved shares, which protect certain heirs.

If a will violates legal shares, heirs can file an Action for Reduction to reclaim their rightful portion.

Wills can be cancelled in court if there’s evidence of coercion, fraud, or procedural errors.

In cases of fraudulent asset transfers, heirs can initiate a title deed cancellation lawsuit to recover their inheritance.

Inheritance Partition Agreements help avoid disputes by allowing heirs to mutually divide property.

When agreement fails, dissolution of partnership actions may be filed to terminate joint ownership through court-led sale or division.

Estate determination ensures all assets and liabilities are recorded, preventing hidden transfers or fraud.

The Inheritance Certificate is an essential document that legally identifies heirs and their shares—required for any legal inheritance transaction.

ASB Partners provides expert guidance throughout every phase—planning, litigation, resolution—to protect your inheritance rights under Turkish law.

Referances

Republic of Turkey Ministry of Justice. (2023). Turkish Civil Code. Retrieved from https://www.mevzuat.gov.tr

Turkish Notaries Union. (2024). Procedures for Will and Inheritance. Retrieved from https://www.tnb.org.tr

Revenue Administration of Turkey. (2024). Inheritance and Gift Tax Guide. Retrieved from https://www.gib.gov.tr

Directorate General of Land Registry and Cadastre. (2024). Title Deed Transactions for Heirs. Retrieved from https://www.tkgm.gov.tr

What is Inheritance Law in Turkey?

Inheritance Law in Turkey governs how a deceased person’s estate is distributed among heirs. It includes regulations for statutory succession, wills, reserved shares, and legal procedures for estate disputes.

Who are the legal heirs under Turkish Inheritance Law?

Legal heirs include the spouse, children, parents, and in some cases, siblings and grandparents. The distribution depends on the degree of kinship and whether a valid will exists.

Can foreigners inherit property in Turkey?

Yes, foreigners can inherit property in Turkey, provided that there is reciprocity between Turkey and their country. However, additional documentation and legal formalities may be required.

How can I cancel a will in Turkey?

A will can be cancelled by filing a lawsuit if it was created under duress, fraud, or if it violates legal formalities. Heirs typically have one year to file a cancellation claim from the moment they become aware of the issue.

What is an Inheritance Certificate and how do I get one?

An Inheritance Certificate (Veraset İlamı) is a legal document proving heirship. It can be obtained from the Civil Court of Peace or a notary if no disputes or foreign heirs are involved.

Whether you’re drafting a will, claiming your rightful share, or contesting a suspicious property transfer, our multilingual inheritance law team is ready to assist you. At Partners ASB, we offer strategic legal guidance tailored to individuals and families navigating complex inheritance issues in Turkey—ensuring clarity, compliance, and confidence at every step.